Virtual POS Integration Guide for Entrepreneurs

Table of Contents

Basics of Virtual POS Integration

Virtual POS integration for online businesses is a critical step for those who want to sell their products or services over the internet. Virtual POS is a type of software used to perform payment transactions through websites and mobile applications as the equivalent of physical POS devices in the internet world..

Virtual POS Integration Process

In order to use the virtual POS system, businesses must make an agreement with a financial institution. After the agreement, the virtual POS integration process begins and this process is a technical process that differs according to institutions and businesses.

Documents and Conditions Required for Virtual POS

To obtain a Virtual POS, a bank or a payment service provider approved by the Banking Regulation and Supervision Agency should be applied. There are some basic requirements such as SSL certificate, product/service content of the e-commerce site and legal texts. Also, the document requirements may vary depending on the type of company and the demands of the organization to be contracted.

Entrepreneurship requires strict management of costs, especially in the start-up phase. Every entrepreneur's budget is limited and therefore, every expenditure is critical. Choosing a virtual POS is one of these important decisions. The right virtual POS system can ease the entrepreneur's financial burden by minimizing transaction fees, commissions and other costs. Moreover, a user-friendly payment system can also increase the revenue potential of the business by increasing customer satisfaction and hence sales. Therefore, for entrepreneurs, choosing a virtual POS is not only a technical choice, but also a matter of financial strategy.

The Importance of Correct Virtual POS Integration

The right virtual POS integration depends on several factors, such as the payment volume of the business, customer portfolio, market dynamics and the location of the payment institution being worked with.

The importance of the right virtual POS integration is becoming increasingly important, especially in the online business world. Choosing the right integration for businesses is a critical decision, as virtual POS integration directly affects the way customers make payments. Here are some reasons why:

- Customer Experience: An easy and reliable payment process increases customer satisfaction. A user-friendly interface and a smooth transaction increases the likelihood that customers will shop again.

- Security: Protecting customer data during payment is essential. The right integration must comply with secure payment infrastructures and data protection standards.

- Multiple Payment Options: To cater to different customer preferences, it is important to offer a variety of payment options. This can range from credit cards to digital wallets.

- Integration Flexibility: Being customizable according to the needs of businesses makes the virtual POS system easier to adapt. It is also important that it is scalable as the business grows.

- Cost Effectiveness: Cost factors such as commission rates and transaction fees can affect the profit margin of the business. Choosing a cost-effective solution is important for long-term financial sustainability.

- Technical Support and Reliability: Technical problems and system outages can negatively affect customer satisfaction and business reputation. Therefore, a solution with reliable and fast technical support should be preferred.

- Legal Compliance: Complying with legal requirements in different geographical regions is an important consideration for businesses. Especially in international transactions, it is necessary to comply with the payment regulations of different countries.

The right virtual POS integration can directly impact customer satisfaction, operational efficiency and financial performance of businesses. Therefore, it is vital for long-term success that businesses choose the solution that best suits their needs.

Ready Virtual POS Integration and Payment Gateway Usage

Ready virtual POS integration provides convenience in terms of time and operational burden, especially for growing businesses. Payment gateway platforms eliminate the need for businesses to carry out separate integration processes with different payment institutions, offering a faster and more efficient payment intake.

Differences between Fintech and Bank Virtual POS

Fintech companies and banks virtual POS integration There are several key differences between their services:

- Technological Innovations and Flexibility: Fintech companies often offer more innovative and flexible solutions. They can quickly adapt to new technologies and payment methods, which enables them to respond quickly to a variety of business needs.

- User Experience: Fintechs often offer user-friendly interfaces and simplified transaction processes, making them particularly attractive to small and medium-sized businesses.

- Integration and Customization: Fintech virtual POS solutions typically offer a wider range of integration and customization. They can be easily integrated into various e-commerce platforms and business software.

- Cost and Wage Structure: Fintechs often offer more competitive pricing and flexible fee structures. They may offer lower transaction fees or different payment plans compared to banks.

- Legal and Regulatory Compliance: Banks are subject to stricter regulatory and legal requirements. Fintechs can sometimes move faster, but this can lead to differences in regulatory compliance.

- Safety and Reliability: Banks generally have a longer history and a strong security infrastructure. Fintechs, on the other hand, may offer innovative security solutions, but may not yet be recognized and trusted by users to the same level.

Both options have their advantages and disadvantages, so it is important for businesses to choose the solution that best suits their needs and preferences.

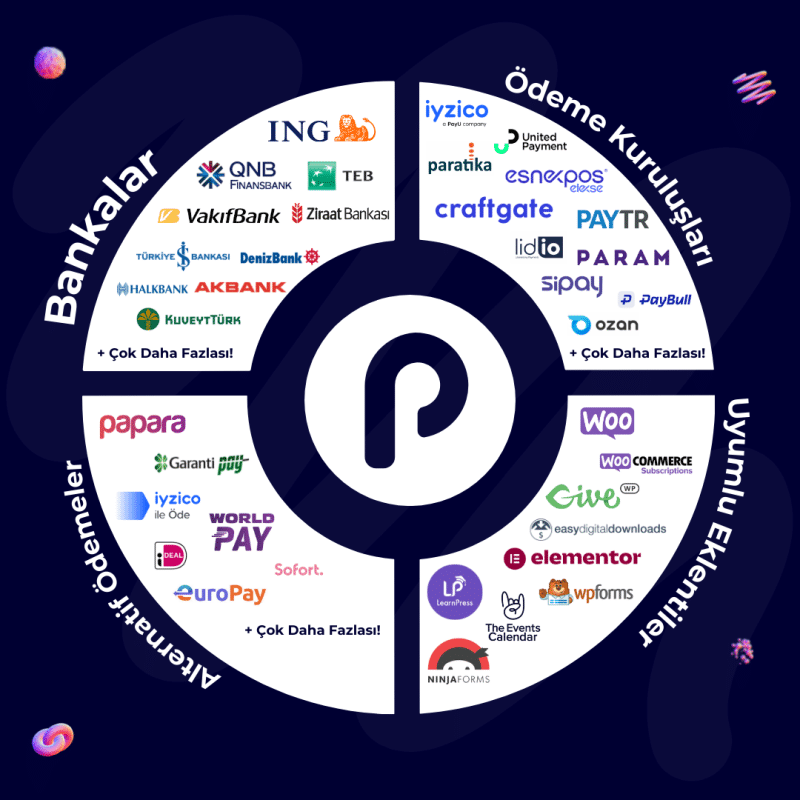

POS Integrator Advantages

POS Integrator is a platform that offers businesses the opportunity to work with different payment institutions in Turkey and abroad. WordPress payment pluginis. Thanks to its ready virtual POS integration and alternative payment methods features, it provides fast and easy access to multiple payment methods for businesses.