Alternative Payment Methods: A World Beyond the Traditional

Table of Contents

What are Alternative Payment Methods? Who Can Use Them?

Alternative payments, online shopping and digital transactions have become an integral part of our lives. With this increasing digitalization, a transformation is taking place beyond traditional banking and credit card systems. So what are these methods and how do they work?

Why Choose Alternative Payment Methods

There are several important reasons why alternative payment methods are preferred. For e-commerce sites in particular, adopting these methods can be critical to growing their business and increasing customer satisfaction.

- Expanding Customer Base: Not all customers use or want to use credit cards. Alternative payment methods offer the possibility to reach a wider range of customers.

- Security: Alternative payment methods such as electronic wallets and mobile payment systems offer enhanced security features. This is especially important for customers who are concerned about cybersecurity.

- Ease of Use: Many alternative payment methods offer a fast and easy checkout experience. This is an important advantage, especially when shopping via mobile devices.

- Low Transaction Fees: Some alternative payment methods offer lower transaction fees compared to traditional credit card transactions.

- International Shopping: Payment methods that offer multi-currency support and international transfer facilities make it easier for e-commerce sites to reach customers in different countries.

Which E-Commerce Sites Should Prefer Alternative Payment Methods?

- Small and Medium Enterprises: Due to lower transaction fees and a large customer base, alternative payment methods can be particularly useful for SMEs.

- Internationally Operating Sites: E-commerce sites operating in multiple countries should adopt these methods to accommodate different regional payment preferences.

- Mobile-Focused Businesses: Businesses where mobile shopping is popular should integrate mobile payment systems to improve the user experience.

- Subscription Based Services: Methods such as direct debit are ideal for automatic payments and regular transactions.

Digital Wallets

Digital wallets are applications that allow users to store their money in a digital format and make various online payments. These wallets are usually used through an app or website and can be linked to users' bank accounts or credit cards. The basic operation of digital wallets, the most popular alternative payment method, can be summarized as follows

- Setup and Installation: Users install a digital wallet app on their smartphone or computer.

- Account Linking: The digital wallet is linked to the user's bank account, credit card or other payment method.

- Safety Features: Verification methods such as fingerprint recognition, facial recognition or PIN are often used for security.

- Making a Payment: Users can shop online, pay bills or transfer money through their digital wallet.

- Communication with Buyers: Thanks to technologies such as NFC (Near Field Communication), digital wallets can also make contactless payments in physical stores.

Some Digital Wallet Brands in Turkey

- BKM Express: A mobile payment system developed by the Turkish Interbank Card Center.

- Papara: An electronic wallet service offering various payment and money transfer transactions.

- Juzdan: Akbank's digital wallet application. You can pay securely for online shopping without sharing your card details.

- Ininal: A prepaid card and digital wallet service that is especially popular among young users.

- Türk Telekom Wallet: A mobile payment application for postpaid line users offered by Türk Telekom.

These digital wallets are designed to facilitate everyday payments and reduce the need to carry physical money.

Payments with Cryptocurrency as an Alternative Payment Method

Cryptocurrencies are decentralized, digitally encrypted currencies. Through cryptocurrency wallets, users can transact with merchants who accept cryptocurrencies such as Bitcoin, Ethereum, etc. These transactions take place on blockchain technology, which offers a high level of security and transparency. Cryptocurrency payments involve the use of digital currencies built on blockchain technology and operate outside of traditional banking systems.

- Creating a Cryptocurrency Wallet: First of all, users need to have a digital cryptocurrency wallet in order to make cryptocurrency transactions. These wallets are used for storing, sending and receiving cryptocurrencies.

- Buying Cryptocurrency: Cryptocurrencies can be purchased through various cryptocurrency exchanges. Popular cryptocurrencies such as Bitcoin, Ethereum, etc. can usually be bought directly with fiat money (e.g. TL, USD, EUR).

- Making a Payment: To pay with cryptocurrency, a certain amount of cryptocurrency is sent to the recipient's cryptocurrency address. This is usually done by scanning the recipient's address in the wallet app or entering it manually.

- Transaction Verification on Blockchain: The cryptocurrency sent reaches the recipient through the blockchain network. Every transaction made during this process is verified by nodes on the network and recorded on the blockchain, making transactions secure and irreversible.

- Variable Transaction Fees and Times: Cryptocurrency transactions take varying amounts of time to complete, depending on transaction fees and the density of the network. Some cryptocurrencies offer faster and cheaper transactions, while others may be slower and more expensive.

In Turkey, cryptocurrency payments are still an emerging area, with some online platforms and retail outlets starting to accept such payments. While cryptocurrencies have advantages such as anonymity, low transaction fees and ease of cross-border transfer, there are also some risks such as price fluctuations and regulatory uncertainty.

Cryptocurrency payments are increasingly gaining popularity as an alternative option to traditional payment methods, but it is important that users are aware of how this technology works and its potential risks.

Some Organizations You Can Get Paid with Coins

- Coinbase Commerce: Coinbase is a popular cryptocurrency exchange worldwide and allows businesses to accept payments with cryptocurrency through a service called Coinbase Commerce. This platform supports Bitcoin, Ethereum and other popular cryptocurrencies.

- BitPay: BitPay is a leading platform that provides payment processing services for Bitcoin and other cryptocurrencies. Providing integration for e-commerce sites, BitPay enables users to make payments with cryptocurrency and businesses to easily accept these payments.

- CoinPayments: CoinPayments has a wide range of services that allow you to accept payments with over 1,000 different cryptocurrencies. It is known for its e-commerce integrations and user-friendly interface.

- GoCoin: GoCoin stands out as another popular cryptocurrency payment processor for businesses. It supports popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin and can be easily integrated with e-commerce platforms.

Receiving Payments with Instant Credit

Another alternative payment method, "Instant credit" or "shopping credit", is a financial service that provides consumers with quick and easy access to credit. Such loans are usually offered at retail outlets or during online shopping and aim to provide customers with instant financing.

Here are the general characteristics of this process:

How does it work?

- Credit Offer at the Time of Purchase: Customers often receive a credit offer when shopping in a store or online.

- Fast Application Process: The loan application is usually simple and customers are asked for basic information and sometimes consent for a credit check.

- Instant Confirmation and Use: Once the application is approved, customers can usually use the loan immediately. This can be especially useful for large and unexpected expenses.

Featuresi

- Flexible Payment Plans: These loans usually offer flexible repayment options and allow the consumer to repay the debt over a short period of time or over a set period of time.

- Interest Rates and Fees: Interest rates and other fees may vary depending on the provider and the terms of the loan.

- Suitable for Small and Large Expenditures: These loans can be used for both small and large purchases, such as technology products, furniture or vacation bookings.

Organizations Integrating Shopping Credits from Turkey

- iyzico: iyzico is a popular payment gateway service that provides payment infrastructure to online stores. It offers solutions that facilitate credit card payments and installment shopping. In the common payment page and pay with iyzico option, it can also open shopping credit on a company basis.

- Lidio: It can be integrated into e-commerce sites and offers various payment options to customers. With its instant credit feature, it offers shopping credit for purchases over 500 TL.

- Compay: Compay connects your customers to their own bank at the time of payment. It enables your customers to pay easily and securely with innovative payment solutions such as instant transfer, instant shopping credit and mobile wallet.

Receiving Payments with Prepaid Cards

Prepaid cards and gift cards are increasingly popular payment methods for financial transactions. Both types of cards offer various benefits and are usually limited to certain spending limits.

In particular, these cards provide a set budget for meals, gifts and other expenses that companies provide to their employees, as well as allowing employees to make these expenses in an easy and controlled manner. The cards are usually used within limits set by the employer, which means convenience and financial control for both employees and employers.

Payment cards such as Multinet, Edenred and Ticket are cards that are widely used in Turkey and offer various advantages and conveniences, especially those offered by companies to their employees. These cards are often used for food, fuel, gifts and other special expenses.

Commonly Used Prepaid Cards from Turkey

- Multinet: is better known as a meal card and is a payment method valid in many restaurants, cafes and grocery stores. It is used to provide employees with a set budget for their daily food expenses. Multinet also sometimes offers options for fuel and gift purchases, and users can track their spending and manage their cards through the mobile app.

- Edenred: It offers meal card services under the Ticket Restaurant name and has a widely recognized network. Edenred also offers gift cards called Ticket Compliments, giving employees flexibility in various spending areas as well as their daily meal needs. These cards aim to make life easier for employees by offering various solutions for different needs.

- Ticket: In addition to its meal card services, Ticket offers a range of options such as gift and benefit cards. These cards give employees a set budget to spend on specific areas of spending and are accepted by a wide network of businesses. The variety Ticket offers gives employees great flexibility in meeting their daily needs.

Common Card Storage and Digital Payment Solutions

Common card storage services such as LidioPass, MasterPass are services that allow users to securely store their credit card details and easily use them for online purchases. Such services are designed to make online payment processes faster and more secure.

Organizations Providing Common Card Custody Services in Turkey

- LidioPass: Allows users to securely store multiple credit card details. Thanks to this service, users do not have to re-enter their card details every time they shop, which significantly speeds up the checkout process. At checkout, users can simply log in to their LidioPass account, select one of their stored cards and pay quickly.

- MasterPass: It is a service offered by Mastercard and has a wide acceptance worldwide. With MasterPass, users can make one-click payments using their registered cards. This further speeds up the shopping process and saves users time. Furthermore, MasterPass offers additional security measures, enhancing the safety of users' card details with features such as single-use security codes for each transaction.

Both services are designed to help users securely store and easily manage their card details when shopping online. LidioPass and MasterPass are important time-saving and security-enhancing tools, especially for frequent online shoppers. These services make the shopping process more streamlined and secure, providing a great convenience for users. Sample grocery shopping platforms. Getir, Hepsi Yemek, Trendyol Yemek.

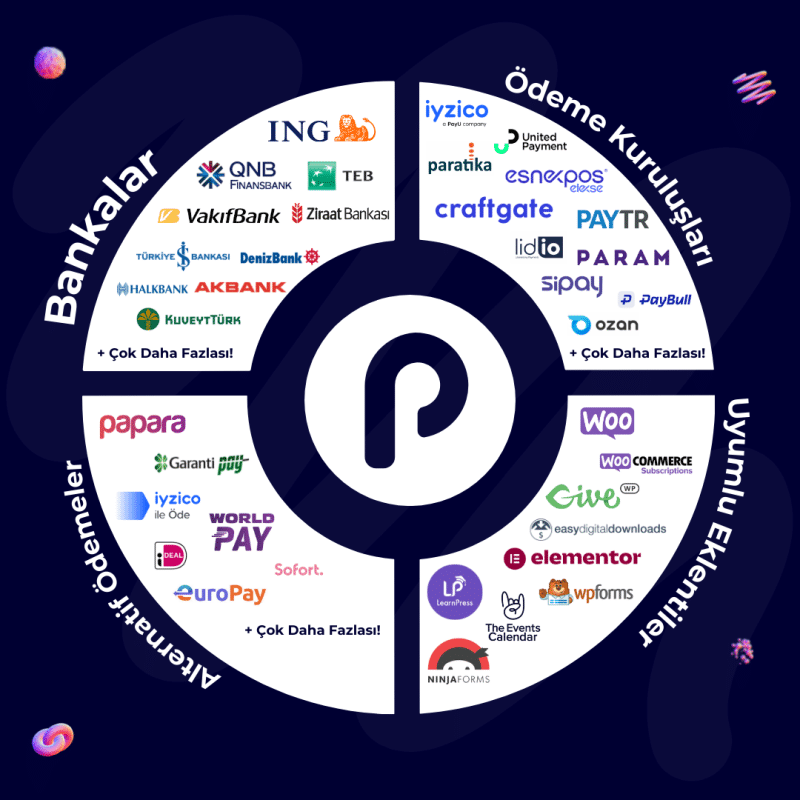

Bonus Receive Custom Amount Payments with WordPress Payment Plugin POS Integrator

Custom amounts allow you to make special offers or deals with your customers. This can increase customer satisfaction and lead to more business. Your customers You can pass the payment with the price you set in the payment form you have created for the payment form. You can reduce your collection costs with POS Integrator that works with popular form plugins.